The Reserve Bank of India has banned the paytm payment bank operations and ordered to discontinue from Febrauary 29. It also clarified that this restriction is only for Paytm bank operations and not for for UPI users.

RBI bans Paytm

Reserve Bank of India imposed restrictions on Paytm company, saying that they are continuously violating the norms of RBI. Accordingly, It has been announced that the operations of Paytm Payments Bank will be banned and discontinued from February 29.

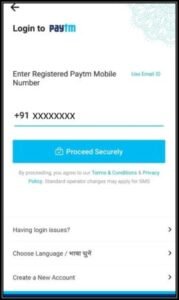

In this digital era, the circulation of digital money transfer has increased everywhere from small villages to big cities. Paytm is the most used application for digital transactions. In this situation RBI banned the Paytm payment Bank service.

Reason for the ban

Earlier, In 2022, Paytm Payments Bank was banned from adding new customers by the RBI. In this case, the audit conducted by the RBI auditors revealed that Paytm Payments Bank was involved in a series of violations of RBI norms.

Following this, additional restrictions have been placed on Paytm payment bank Ltd, under section 35A of Banking Regulation Act. Accordingly, the operations of the Payments Bank, which facilitates new deposits and money transfers in Paytm, will be discontinued from 29 February. The Paytm app has also been banned from providing FASTag and prepaid facilities.

Whereas, there is no restriction on using the existing amount in Paytm wallets and here is no restriction on using Paytm UPI services. People can continue to use the Paytm app to transfer money through UPI.

Comments 1