Vedanta Limited, a leading natural resources company, has announced its audited consolidated results for the fourth quarter Q4 and fiscal year ended March 31, 2024. Despite facing headwinds in the commodity market, Vedanta showcased robust performance across its key business segments, demonstrating resilience and operational excellence.

Vedanta Ltd on Thursday reported a 27% year-on-year (YoY) drop in consolidated net profit (attributable to owners of Vedanta) at Rs 1,369 crore for the March quarter compared with Rs 1,881 crore in the same quarter last year.

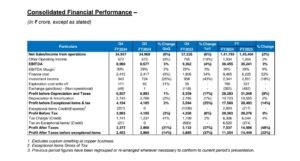

In the fourth quarter of FY24, Vedanta reported a consolidated revenue of ₹34,937 crore, remaining flat compared to the previous quarter. However, the company witnessed a 3% quarter-on-quarter (QoQ) increase in EBITDA to ₹8,969 crore, with a strong EBITDA margin of approximately 30%. For the fiscal year, Vedanta achieved the second-highest annual revenue of ₹141,793 crore, supported by higher volumes across businesses and favourable exchange rate movements.

Profitability and Leverage of Vedanta

The Profit After Tax (PAT), excluding exceptional items, stood at ₹2,453 crore for the quarter and ₹11,254 crore for the fiscal year. Notably, Vedanta recorded a surge in quarterly free cash flow (pre-capex) by 131% QoQ, amounting to ₹9,948 crore. Furthermore, the company successfully delivered ₹6,155 crore QoQ, significantly improving its Net Debt/EBITDA ratio to 1.5x from 1.7x in the previous quarter.

Zinc International

In FY24, Gamsberg’s cost of production (CoP) decreased by 3% year-on-year (YoY), demonstrating operational efficiency and cost optimization efforts. Additionally, the division achieved its highest quarterly lead recovery at BMM in Q4 FY24, reaching 87.5%. Furthermore, Gamsberg recorded its highest monthly zinc recovery of 82.3% in October 2023, reaffirming Vedanta’s commitment to excellence in zinc production.

Oil and Gas

Vedanta’s oil and gas segment achieved significant milestones, including the approval of India’s first Field Development Plan under the Open Acreage Licensing Policy (OALP) regime for the Jaya field in Gujarat. Production commenced with an initial plan to deliver over 3 thousand barrels of oil equivalent per day (kboepd). The division reported an average daily gross operated production of 127.5 kboepd, with efforts to offset natural decline through infill wells across all assets.

Iron Ore

Vedanta’s iron ore division witnessed record-high Karnataka saleable ore production and sales, reaching 5.6 million tonnes and 5.9 million tonnes, respectively. Moreover, the division reported its highest-ever pig iron production at 831kt, marking a 19% YoY increase. The operationalization of the Bicholim mine in Goa, with a capacity of 3 MTPA, signifies Vedanta’s commitment to revitalizing mining operations in the region.

Aluminium

Vedanta’s aluminium segment achieved its highest-ever annual aluminium cast metal production of 2,370 kt, up 3% YoY, and alumina production at the Lanjigarh refinery increased by 1% YoY to 1,813 kt. The division sustained cost reduction efforts for the seventh consecutive quarter, reaching $1,711/t in Q4, positioning Vedanta in the first quartile of the global cost curve. Furthermore, the commissioning of Train-I at the Lanjigarh refinery expanded the total capacity to 3.5MTPA, enhancing operational capabilities.

Zinc India

Hindustan Zinc, a key player in Vedanta’s zinc division, emerged as the 3rd largest producer of silver globally. The division reported its highest-ever annual mined metal, refined metal, and silver production, highlighting operational excellence and efficiency. With consecutive quarters of cost optimization and a strong foothold in the global zinc mines cost curve, Vedanta’s zinc division remains well-positioned for sustained growth and profitability.

Vedanta Limited Leadership Insights

Mr. Arun, Executive Director of Vedanta, expressed satisfaction with the company’s performance, stating, “FY 2023-24 has been a remarkable year for Vedanta. We have achieved record production across our key businesses, a testament to our consistent focus on operational excellence. This focus, coupled with our commitment to cost leadership, ensured strong margins even during a challenging commodity market.” He emphasized Vedanta’s commitment to sustainability and operational growth, outlining strategic priorities for the future.

Mr. Ajay Goel, Chief Financial Officer of Vedanta, highlighted the company’s outstanding financial results, emphasizing operational excellence and cost optimization initiatives. He underscored Vedanta’s balanced capital structure and commitment to value creation for shareholders, reflecting confidence in the company’s future prospects.

Financial Overview:

– Net Profit Percentage: 27 percent

– Net Profit: ₹1369 crore

– Quarterly Revenue: ₹34,937 crore

– Quarterly EBITDA: ₹8,969 crore

– Quarterly Free Cash Flow (Pre-Capex): ₹9,948 crore

– Deleveraging Amount: ₹6,155 crore

– Net Debt/EBITDA Ratio: Improved to 1.5x from 1.7x

Vedanta Limited’s strong performance in the fourth quarter of FY24 reflects its resilience and strategic focus in a challenging business environment. With robust financial results, industry-leading operational performance, and a steadfast commitment to sustainability, Vedanta reaffirms its position as a leading player in the natural resources sector, poised for continued growth and value creation.

Comments 1