Finolex Cables saw its shares soar to a record high following the release of its impressive Q4FY24 results. The company, India’s largest manufacturer of electrical and communication cables, reported robust growth in revenue and profit, propelling its stock to new heights and solidifying its position as a market leader.

Financial Performance of Finolex

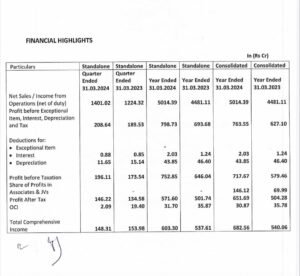

For the fourth quarter ending March 31, 2024, Finolex Cables posted a consolidated net profit of ₹186.1 crore, a 6.3% increase from ₹175 crore in the same period last year. Sequentially, net profit surged 23% from ₹151 crore in the previous quarter. Revenue from operations jumped 18.3% year-on-year to ₹1,450.69 crore from ₹1,226.14 crore in Q4FY23.

At the operational level, the company’s EBITDA rose by 11.2% to ₹162 crore in Q4FY24, up from ₹145.7 crore in the year-ago period. However, the EBITDA margin saw a slight contraction to 11.6% from 11.9% last year.

For the full fiscal year 2023-24, Finolex reported a net profit increase of 14% to ₹571.60 crore from ₹501.74 crore in FY23, with total income from operations rising 12% to ₹5,232.44 crore from ₹4,679.24 crore in the previous fiscal year.

Following the announcement, Finolex Cables’ stock opened higher at ₹1,165 on the BSE and surged 18.97% to a record high of ₹1,361.95. The multibagger stock, which has delivered returns of 266% over the past two years, was the top gainer on the BSE on Friday, with a market capitalization of ₹20,398 crore.

The stock’s technical indicators showed it trading higher than the 20-day, 50-day, 100-day, and 200-day moving averages, although it was lower than the 5-day and 10-day moving averages. The relative strength index (RSI) stood at 70.8, indicating that the stock is in the overbought zone.

In addition to the strong financial results, Finolex Cables’ board recommended a dividend of ₹8 per equity share of ₹2 each fully paid up (400%) for the fiscal year ended March 31, 2024. This dividend is subject to shareholder approval at the forthcoming annual general meeting.

The company’s recent growth is attributed to volume-led expansion in major segments, new product introductions, and strategic pricing actions to maintain margins. Specifically, electrical wires and cables showed significant volume growth of 15% and 50% respectively in Q4FY24 compared to the previous year, while the communication cables segment saw an average volume increase of 14%.

Finolex is progressing well on its previously announced plans to establish an E-Beam facility and a preform manufacturing plant. The first E-Beam equipment is currently under commissioning and expected to be operational shortly, with market offerings anticipated by August/September 2024. The second equipment is expected to arrive soon. Phase I of the preform facility is projected to be operational by January/February 2025.

The company’s management expressed optimism about the future. “The robust financial performance in Q4FY24 reflects our strategic initiatives and the strong demand for our diverse product range,” said a company spokesperson. “Our ongoing expansion plans, including the E-Beam facility and preform manufacturing plant, are on track and will further strengthen our market position.”

Finolex Cables continues to dominate the market with its extensive range of electrical and communication cables used in various applications such as automobiles, lighting, cable TV, telephony, and industrial equipment. The company has also expanded its product range to include electrical switches, LED-based lamps, fans, low-voltage MCBs, and water heaters.

Finolex Cables continues to dominate the market with its extensive range of electrical and communication cables used in various applications such as automobiles, lighting, cable TV, telephony, and industrial equipment. The company has also expanded its product range to include electrical switches, LED-based lamps, fans, low-voltage MCBs, and water heaters.