During her Union Budget 2024 speech, Finance Minister Nirmala Sitharaman disclosed significant modifications to the new income tax system. Many salaried taxpayers would gain from these changes by Rs 17,500 if they chose to use the new income tax regime!

Personal Income Tax Notifications

Regarding personal income tax rates, I would like to make two notifications to those who have chosen to utilize the new tax system. A paid employee under the new tax regime might save up to Rs 17,500 in income tax as a result of these changes, according to Sitharaman.

Increased Standard Deduction

The new income tax system has increased the standard deduction from Rs. 50,000 to Rs. 75,000. Additionally, the income tax slabs have been changed for FY 2024–2025, such that income up to Rs 7 lakh is now subject to the 5% tax rate. There have also been a few further adjustments made.

Tax Advantage of Rs 17,500

The advantages will differ at different income levels, as the accompanying table makes clear. The cess is not included in the Rs 17,500 basic income tax rebate that FM Sitharaman stated. Additionally, surcharges for higher income levels are excluded. According to a study by EY, you would no longer be required to pay income tax on amounts up to Rs 7.75 lakh. You will set aside Rs 10,000 a year (without cess) for income up to Rs 10 lakh. The advantage will increase if Cess is included.

New Income Tax Brackets

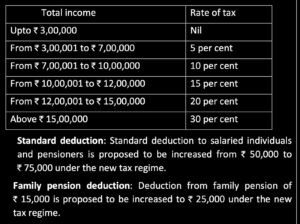

The following are the new income tax slabs under the new or simplified tax regime, per the announcements made by FM Sitharaman:

- No tax for income up to Rs 3 lakh

- 5% tax rate for income between Rs 3 lakh to Rs 7 lakh

- 10% tax rate for income between Rs 7 lakh and Rs 10 lakh

- 15% tax rate for income between Rs 10 lakh and Rs 12 lakh

- 20% tax rate for income between Rs 12 lakh and Rs 15 lakh

- 30% tax rate for income above Rs 15 lakh